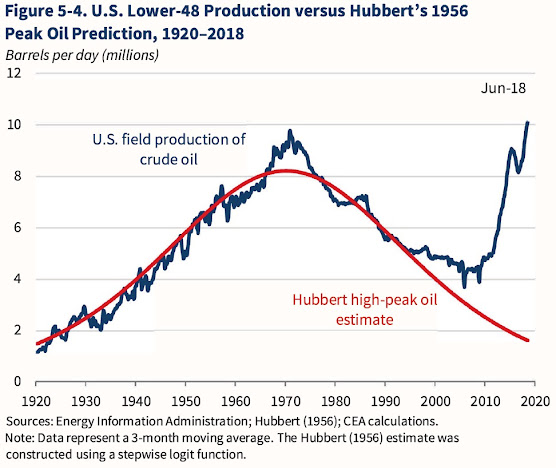

I defined this image as "The most amazing graph of the 21st century," and I argued that the rapid inversion of the declining trend of crude oil production is the cause of the US government's currently aggressive foreign policy. But the vagaries of oil production in the US haven't ceased to amaze us. We are now seeing a desperate attempt to keep oil production growing, even at the cost of dumping everything done so far in terms of "green" policies to mitigate climate change and ecosystem disruption. It is a major historical change.

Sometimes, things change so fast in our world that we are left bewildered at seeing the rapid disappearance of the world we had thought was normal. The Covid pandemic was a case in point. It changed our habits, how we see ourselves and others, and affected our fundamental rights. In less than a couple of years, it propelled us into a "new normal" that became the way things are and have to be.

The wave of rapid changes is not over. Now, change is sweeping through energy and environmental policies, and not in a good direction. A recent article in "

The Epoch Times" reports about a document approved by the House Natural Resources Committee with the title, "

GOP-Led House Panels Shift Gears, Go Full Throttle for Domestic Energy Production." It is a true tsunami poised to propel us into another kind of "new normal." Here are some excerpts.

"Republicans made it clear that many initiatives passed under the Biden administration promoting electric vehicles, carbon capture, green energy, and environmental protection are on the proverbial chopping block.

"Among the proposals that will dominate the committee’s and its subsidiary panels’ agendas in the coming months are bills prohibiting restrictions on hydraulic fracking without congressional approval, expanding natural gas exports, repealing the IRA’s Green House Reduction Fund, and amending the Clean Air, Toxic Substances Control, Solid Waste Disposal, and National Gas Tax acts.

"Within the tranche of proposed legislation on the committee’s “unleashing American energy agenda” are bills calling for permitting reform, promoting development of “critical minerals,” and prohibiting the import of Russian uranium.

"Current energy policies not only degrade the economy but imperil national security... We are exporting wealth from here in the United States, many times to our adversaries, because of a not-in-my-backyard mentality,

"Grijalva’s proposed amendment to incorporate a statement that the impacts of climate change be weighed in evaluating proposals was defeated on a 21–15 party-line tally."

And more like that.

Let's try to unravel this set of ideas. We can start with the key sentence: "prohibiting restrictions on hydraulic fracking." It means that the Republicans want to ramp up the production of natural gas and crude oil at all costs, and the hell with "Climate Change" and "environmental protection." These silly ideas came from those scientists who think they deserve a salary just because they spend their time scaring the public with invented catastrophes that never arrive. Who do they think they are?

The Republicans seem to be riding a wave of public opinion that sees environmental policies in a bad light. Indeed, most people were never enthusiastic about making sacrifices for a nebulous entity called "the environment." But, today, the public's trust in science has taken a considerable beating from the Covid crisis, and it is becoming more and more difficult to convince people to act in the name of a "science" that they see with increasing suspicion. Independently of individual opinions, when things get tough, most people tend to agree that there is no space for niceties and luxuries, as environmental policies are usually perceived.

Apart from dumping regulations, neither the Republicans nor the general public seem to be able to see the

glaring contradiction in what they are planning to do. Increasing oil and gas production means that more oil and gas will be used and exported. But once oil is produced and burned, it is gone. Then, the country will be impoverished, having lost some of its natural resources. (Unless, of course, you think that oil and gas are an infinite resource.... and that's precisely what the US elites

think.). This is a classic case of hastening one's own doom, but it is normal. It happens all the time.

Besides, there is an even more worrisome point in these ideas. Can fracking production be actually increased? The sentence about prohibiting restrictions on hydraulic fracking actually smacks of desperation. During the past 10 years, an incredibly rapid increase in oil production was obtained without the need for such a radical legislation. So why is it needed now? It may be a way for senators to show their determination, but it is more likely that the fracking industry is in trouble, unable to recover after the drop caused by the Covid pandemic.

You see that the US oil production collapsed in 2020 due to the Covid epidemic. Then, it restarted growing but has yet to return to the record level of Nov 2019. During the years of fast growth, up to 2019, it had grown more than 1 million barrels per year, a nearly 10% increase. It was a rate never seen during the whole history of US oil production. But, during the current recovery, it has declined to about half that value. The forecasts see a further reduction to nearly zero growth so that the 2019 record may not be breached before December 2024 -- if ever. Note also how production went down for about 6 months before the Covid shock. Something was rotten in Texas already by then.

What's happening? One thing is clear: the US oil industry can no longer sustain the incredible growth rate that had been the rule up to 2019. We may well be

close to the second (and final) peak of oil production in the US (as also noted

by others)

So, as in the old Chinese malediction, we live in interesting times. An empire that does not expand is a dead empire, and the American Empire needs energy to keep its expansion going. A war, after all, is just a continuation of the economy by other means: the market is the battlefield, and "programmed obsolescence" is assured by the competitor's products. During the past decade, the US empire has accumulated considerable economic potential through the "fracking miracle." This potential has been turned in large part into a military potential. It is now time to dissipate this potential; it is the primary reason for what we see in the world nowadays. It is a concept explored in depth by

Ingo Piepers.

The American elites understand what's happening. Hence, the effort to prop up the oil industry at all costs. So, will the Empire succeed in surviving for some more years? The current war is not being fought on the battlefield but on the oil fields. The side that runs out of fuel first will be the loser.

In the long run, anyway, the winner will also lose: at some moment, production by fracking will not just decline: it will crash in one of the most brutal

Seneca Cliffs ever witnessed by humankind. But do not despair: humankind has been thriving before the age of oil, and it may well do the same afterward. It will just be a very different world for those who will survive to see it.

Below is a post I published in 2015, where I compared the growth of shale oil production to that of cod fishing in the Atlantic. In both cases, producers were blinded by a false sensation of abundance generated by production growth. They didn't realize that the faster you extract it, the faster you run out of it.

The shale oil "miracle": how growth may falsely signal abundance.

Originally published on "Cassandra's Legacy, February 24, 2015

Oil production (all liquids in barrels per day) in the US and Canada. (From Ron Patterson's blog). Does this rapid growth indicate that the resources are abundant and that all the worries about peak oil are misplaced? Maybe not... Sometimes, we use a simple metric to evaluate complex systems. For instance, a war is a complex affair where millions of people fight and struggle. However, in the end, the final result is a yes/no question: either you win or you lose. Not for nothing, General McArthur said once that "

there is no substitute for victory."

Think of the economy: it is an immense and complex system where millions of people work, produce, buy, sell, and make or lose money. IEventually the final result is a simple yes/no question: either you grow, or you don't. And what McArthur said about war can be applied to the economy: "

there is no substitute for growth."

But complex systems have ways of behaving, surprising you that can't be reduced to a simple yes/no judgment. Both victory and growth may create more problems than they solve. Victory may falsely signal a military might that doesn't exist (think of the outcome of some recent wars....), while growth may signal an abundance that is just not there.

Look at the figure at the beginning of this post (from

Ron Patterson's blog). It shows the oil production (barrels/day) in the US and Canada. The data are in thousand barrels per day for "crude oil + condensate," and the rapid growth for the past few years is primarily due to tight oil (also known as "shale oil") and oil from tar sands. If you follow the debate in this field, you know that this growth trend has been hailed as a great result and as the definitive demonstration that all worries about oil depletion and peak oil were misplaced.

Fine. But let me show you another graph, the US landings of North Atlantic Cod up to 1980 (data from

Faostat).

Doesn't it look similar to the data for oil in the US/Canada? We can imagine what was being said at the time; "new fishing technologies dispel all worries about

overfishing" and things like that. It is what was said, indeed (see

Hamilton et al. (2003)).

Now, look at the cod landings data up to 2012 and see what happened after the great burst of growth.

This doesn't require more than a couple of comments. The first is to note how overexploitation leads to collapse: people don't realize that by pushing for growth at all costs, they are destroying the very resource that creates growth. This can happen

with fisheries just as with oil fields. But, also note that we have another case of a "

Seneca Cliff," a production curve where the decline is much faster than growth. As the ancient Roman philosopher said, "

The road to ruin is rapid." And this is exactly what we could expect to happen with tight oil.