"Republicans made it clear that many initiatives passed under the Biden administration promoting electric vehicles, carbon capture, green energy, and environmental protection are on the proverbial chopping block.

"Among the proposals that will dominate the committee’s and its subsidiary panels’ agendas in the coming months are bills prohibiting restrictions on hydraulic fracking without congressional approval, expanding natural gas exports, repealing the IRA’s Green House Reduction Fund, and amending the Clean Air, Toxic Substances Control, Solid Waste Disposal, and National Gas Tax acts.

"Within the tranche of proposed legislation on the committee’s “unleashing American energy agenda” are bills calling for permitting reform, promoting development of “critical minerals,” and prohibiting the import of Russian uranium.

"Current energy policies not only degrade the economy but imperil national security... We are exporting wealth from here in the United States, many times to our adversaries, because of a not-in-my-backyard mentality,

"Grijalva’s proposed amendment to incorporate a statement that the impacts of climate change be weighed in evaluating proposals was defeated on a 21–15 party-line tally."

And more like that.

Let's try to unravel this set of ideas. We can start with the key sentence: "prohibiting restrictions on hydraulic fracking." It means that the Republicans want to ramp up the production of natural gas and crude oil at all costs, and the hell with "Climate Change" and "environmental protection." These silly ideas came from those scientists who think they deserve a salary just because they spend their time scaring the public with invented catastrophes that never arrive. Who do they think they are?

The Republicans seem to be riding a wave of public opinion that sees environmental policies in a bad light. Indeed, most people were never enthusiastic about making sacrifices for a nebulous entity called "the environment." But, today, the public's trust in science has taken a considerable beating from the Covid crisis, and it is becoming more and more difficult to convince people to act in the name of a "science" that they see with increasing suspicion. Independently of individual opinions, when things get tough, most people tend to agree that there is no space for niceties and luxuries, as environmental policies are usually perceived.

The shale oil "miracle": how growth may falsely signal abundance.

Originally published on "Cassandra's Legacy, February 24, 2015

Sometimes, we use a simple metric to evaluate complex systems. For instance, a war is a complex affair where millions of people fight and struggle. However, in the end, the final result is a yes/no question: either you win or you lose. Not for nothing, General McArthur said once that "there is no substitute for victory."

Think of the economy: it is an immense and complex system where millions of people work, produce, buy, sell, and make or lose money. IEventually the final result is a simple yes/no question: either you grow, or you don't. And what McArthur said about war can be applied to the economy: "there is no substitute for growth."

But complex systems have ways of behaving, surprising you that can't be reduced to a simple yes/no judgment. Both victory and growth may create more problems than they solve. Victory may falsely signal a military might that doesn't exist (think of the outcome of some recent wars....), while growth may signal an abundance that is just not there.

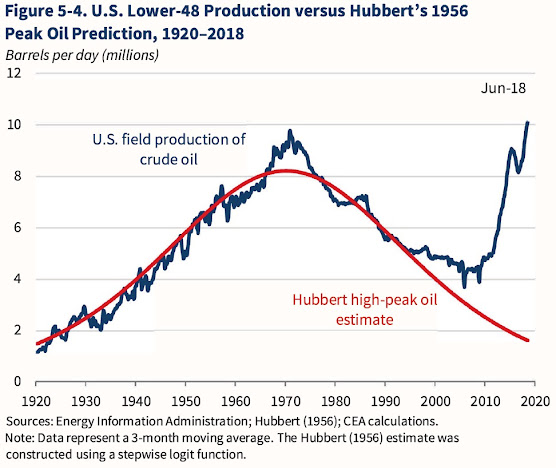

Look at the figure at the beginning of this post (from Ron Patterson's blog). It shows the oil production (barrels/day) in the US and Canada. The data are in thousand barrels per day for "crude oil + condensate," and the rapid growth for the past few years is primarily due to tight oil (also known as "shale oil") and oil from tar sands. If you follow the debate in this field, you know that this growth trend has been hailed as a great result and as the definitive demonstration that all worries about oil depletion and peak oil were misplaced.

Fine. But let me show you another graph, the US landings of North Atlantic Cod up to 1980 (data from Faostat).

Doesn't it look similar to the data for oil in the US/Canada? We can imagine what was being said at the time; "new fishing technologies dispel all worries about overfishing" and things like that. It is what was said, indeed (see Hamilton et al. (2003)).

Now, look at the cod landings data up to 2012 and see what happened after the great burst of growth.

This doesn't require more than a couple of comments. The first is to note how overexploitation leads to collapse: people don't realize that by pushing for growth at all costs, they are destroying the very resource that creates growth. This can happen with fisheries just as with oil fields. But, also note that we have another case of a "Seneca Cliff," a production curve where the decline is much faster than growth. As the ancient Roman philosopher said, "The road to ruin is rapid." And this is exactly what we could expect to happen with tight oil.